Piggy Bank Friday

Piggy Bank Friday

From an article by Edutopia

Some primary schools in the USA are running Piggy-Bank Friday - an initiative with 10-11 year olds to develop financial literacy. At one school. pupils saved over £24,000 in one year.

They build a savings habit through setting up a real bank account, make weekly deposits with Credit Union bankers at their school, track their balances, and receive monthly financial literacy lessons.

When pupils leave the school to go on to secondary education their accounts are closed, and they have the option to either cash their savings or open a new account with the local Credit Union. The head of one of the schools says, "I've never heard a kid say, 'I'm going to spend it.'.”

How is it done?

Through partners. A local Credit Union, a charity which developed the financial literacy curriculum (this could be pfeg in the UK) and volunteers who donated their time and the materials to build an on-campus 'bank' at the school site (this could be the PTA in UK). They turned a school caretaker's closet into a bank teller counter and created decals for the walls with advice on how to save money.

The school sends a letter home to their students' parents, letting them know about the program. Parent permission is required for students to participate, just as it would be required for a minor to open an account with any bank. Parents need to fill out and sign their child's deposit book, and they are required to sign each deposit slip, acknowledging that they know how much money their child is depositing each week.

Each student gets a deposit book to track their savings, deposit slips to make their deposits, and a deposit bag to hold both, as well as a piggy bank to save their money over the holidays. Stewardship over these materials empowers financial awareness and an authentic involvement in the process. They're able to tracking every single deposit that they're making. They know what their current balances are, and they also have a goal that they've written down.

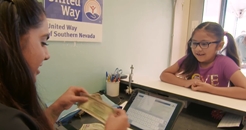

A Credit Union representative comes to school and each participating student opens an account with them at the beginning of the year. The Credit Union staff can continue to come or volunteers can be found to be the weekly tellers, each Friday.

Students can deposit their money - even just a penny - before or during school. Before school, they can come on their own or with their parents to make a deposit. The bank tellers open their door each Friday 30 minutes before school starts. During the school day, students make deposits with their class, one classroom at a time, as scheduled by the administration.

When students come to deposit money, the tellers:

-

Check that the deposit slip is filled out correctly

-

Deposit the money and stamp their deposit slips

-

Ask about their long- and short-term goals

-

Give them a sticker, acknowledging their deposit, and congratulate them

Once all the money is collected each week, someone from the Credit Union picks up the deposits from the school or a trusted agent takes the money to the Credit Union branch.

The curriculum includes monthly classes on; Needs vs. wants, Long-term and short-term goals, Budgeting, Smart spending. Banking. This can be tied in to English and Maths.

The success of the program depends on teachers. If teachers don’t lay the groundwork for the partners who will teach the financial-literacy lessons, if they don't remind their students to bring in money to deposit on Fridays, and if they don't brainstorm ideas with their students on how to earn money, then it won't be successful. The teachers' role is to encourage, support, and get their students excited about saving money.

Watch this 4 minute video about the scheme in one school:

See more details here.

An equivalent programme in the UK is Lifesavers but it seems to have less emphasis on a weekly savings event which to me creates excitement and demonstrates practical reality i.e. moving from head to heart. Why not investigate further or adapt the above if you are involved in schools.

Retweet about this article:

From an article by Edutopia, 24/10/2017