In Too Deep: an investigation into debt and relationships

In Too Deep: an investigation into debt and relationships

From a report by Relate

In November 2017, Relate published a report, sponsored by Provident Financial, which explored the links between debt and relationships.

Bank of England figures show consumer borrowing grew by 10% in the year to June 2017 to £210bn – the highest since December 2008. Problem debt can have a devastating impact on families, causing difficulties meeting basic needs, poverty, stress, and poorer mental and physical health.

The report looks at the considerable negative impacts that debt problems can have on family relationships. Struggling with problem debt can lead to relationship distress, increased conflict, decreased positive communication, partners blaming each other and increasing mistrust, and – as a result – relationship breakdown.

Poverty and strains on family finances can seriously undermine relationship quality and stability, and relationships become vulnerable as arrears mount up.

They found that one in four people who have been in debt say debt has a negative impact on their couple relationship. One in ten people argue with their partner about money, debt or finances at least once a fortnight and one in ten (10%) people have experienced a relationship breakdown due (at least in part) to debt.

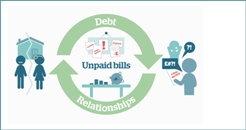

Their findings paint a picture of a relentless cycle, whereby debt can have a profoundly negative impact on relationship quality and stability and, equally, negative relationship dynamics can actively worsen and create debt problems.

They also explored the contribution of relationships to debt and the ways in which relationship dynamics can affect couple and family finances.

They found that one in seven (14%) adults have hidden debt from a partner - and half of these are still hiding it. Almost half of debt advice clients have hidden debt from a partner.

93% of debt advisers believe personal and family relationships are important to clients’ ability to manage debt and a third of debt advisers perceived large/very large demand among clients for relationship support.

The research indicates the importance of open communication and a shared approach over finances within relationships. When people hide their debt from their partner or family, this can be particularly problematic for both the relationship and for their ability to deal with the debt. Couples who make decisions together experience fewer financial problems. Additionally, the different emotional meanings, values and expectations attached to debt and money that people have, can be central factors underlying conflicts within relationships over money. All of this demonstrates the relational and intergenerational context of financial capability, as well as the financial context of relationships.

To address debt and financial capability on one hand or relationship distress on the other is to see only one side of the coin. The implication of these findings for policy and support services’ practice are clear: recognising the interdependencies between debt and relationships is necessary to provide the most effective support for families.

Increasing collaboration between relationship support and debt advice may deliver significant benefits. Many families trapped in problem debt experience profound pressures on their relationships and, alongside the more practical support of debt advice, may benefit from emotional and therapeutic support to strengthen their relationships. Enhancing families’ communication, positive problem solving, and conflict management skills in conjunction with providing debt advice to families in problem debt may increase both financial capability and relationship quality.

Download the report from here.

See also Within My/Our Reach - an opportunity to improve relationships

Retweet about this article:

From a report by Relate, 12/12/2017